Where were you the last time your tax team hit a crunch point? Maybe it was quarter-end. Maybe a new regulation landed like a meteor. Or maybe your star manager gave two weeks’ notice—right in the middle of compliance season.

Here’s the truth: the traditional hiring model isn’t optimal for today’s dynamic tax world. It wasn’t designed for constant regulatory shifts, retiring Baby Boomers, or the race to keep up with digital mandates. If you’re relying solely on permanent staff to weather every storm, you’re playing a high-risk game in a low-margin world.

Smart tax leaders are adapting. They’re embracing contract talent not as a stopgap, but as a strategic edge—a way to stay agile, access niche expertise, and avoid the trap of rushed, expensive hires.

The New Reality: Flexibility is the New Stability

Let’s face it: the talent pipeline is tightening. Senior experts are leaving the workforce, and replacements aren’t arriving with the same experience—or fast enough. Meanwhile, governments are layering on new rules, technologies, and deadlines.

Building a rock-solid core team is still essential. But what separates thriving tax departments from the rest? They supplement that core with contract professionals—and not just to plug holes, but to extend capability and buy time for smarter decisions.

This shift isn’t just reactive. It’s a proactive move to:

- Smooth out seasonal spikes

- Access specialized skills on demand

- Preserve institutional knowledge while permanent roles are filled

Contract talent becomes your pressure valve and innovation lever—a force multiplier for the core team.

Three Strategic Use Cases That Deliver Real Results

1. Compliance Surge Management

Tax season is predictable, but the strain it puts on your team isn’t. Rather than stretch your people thin or pull focus from planning work, bring in contract pros to handle data gathering and return prep.

The payoff? It’s more than just workload relief. Studies show companies save 35–45% on compliance costs when they source contractors through niche recruiting firms. Go direct through trusted networks or referrals? You might save up to 60%.

2. Project-Based Expertise

Need a tax expert for that global expansion, Pillar Two modeling, or ERP integration? Contractors bring pinpoint expertise exactly when needed—without adding to your long-term headcount.

You get world-class insight, solve the problem, and move on. No bloated payroll, no sunk cost.

3. Smart Scaling and Role Validation

Hyper-growth companies often don’t know exactly what their tax function should look like. Enter: the contractor-as-architect. These pros build processes, test technologies, and write the playbook.

When you’re ready to hire permanently, the function is already humming. The new employee walks into a proven system with clear expectations. Result? Faster onboarding, better fit, and far fewer mis-hires.

Skills-First Hiring: Beyond the Resume

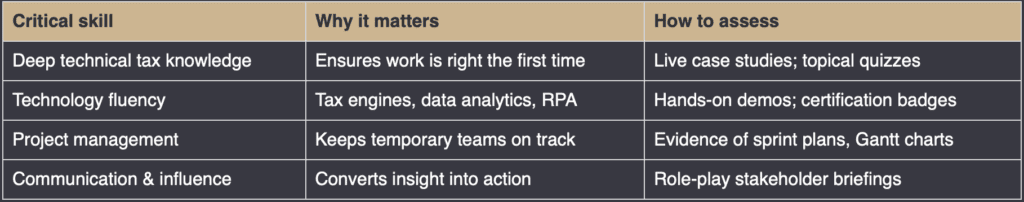

The talent crunch is forcing a welcome shift from credential worship to capability assessment. Leading departments now emphasize:

- Core competencies over impressive titles—deep technical knowledge, data mastery, project management, and clear communication

- Real-world assessment through case studies and live problem-solving rather than resume screening

- Technology fluency as non-negotiable, covering compliance software, analytics tools, and collaboration platforms.

Organizations adopting this framework fill contractor roles 25-40% faster time-to-hire while maintaining quality standards.

Integration Is Everything

Not all contractor experiences are created equal. The difference between good and great comes down to how well these pros are brought into the fold.

Top-performing tax teams follow a repeatable playbook:

- Define scope and expectations early. Set clear milestones, document everything, and ensure knowledge stays behind when contractors move on.

- Standardize onboarding. Fast system access and a focused orientation can slash ramp-up time by 43%.

- Stagger schedules. Overlapping start and end dates ensure smooth transitions and zero drop-offs during handoffs.

- Stay aligned. Weekly 15-minute check-ins prevent small issues from becoming big ones.

Great integration isn’t accidental—it’s designed.

What About the Cost?

Yes, seasoned contractors command premium hourly rates—often 50–75% more than fully-loaded employees. But here’s the kicker: they’re still 60–70% cheaper than what Big 4 firms charge for the same level of work.

Even better? No hidden overhead. Their rate includes everything: vacation, benefits, bench time, even training. And when the work’s done, you’re not paying for idle hands.

The real power, though, is flexibility. You scale up or down as needed, match the right expertise to the right moment, and keep your budget under control.

The Future is Already Here: Three Trends Accelerating the Shift

- Hyper-specialization: Contractors are carving out ultra-specific niches—from cryptocurrency compliance to global minimum tax modelling.

- Borderless recruiting: With remote work, companies can now tap top talent from across the continent, backed by collaboration tech and secure data sharing.

- New engagement models: Beyond hourly work, expect to see more managed service teams, fixed-fee projects, and outcome-based contracts.

The Bottom Line

Treating contract talent as a core part of your strategy—not just a panic button—unlocks serious advantages:

- Agility to scale fast

- Access to niche skills

- Cost control without compromise

- Continuity that protects your institutional knowledge

The best tax leaders don’t just hire. They design talent ecosystems that move with the market.

Ready to see how your peers are structuring their teams? We’ve got the frameworks, benchmarking data, and playbooks to help you hire smarter—and win faster.

Let’s talk. Because in this game, adaptability isn’t optional. It’s your edge.